Buyer’s purchasing power

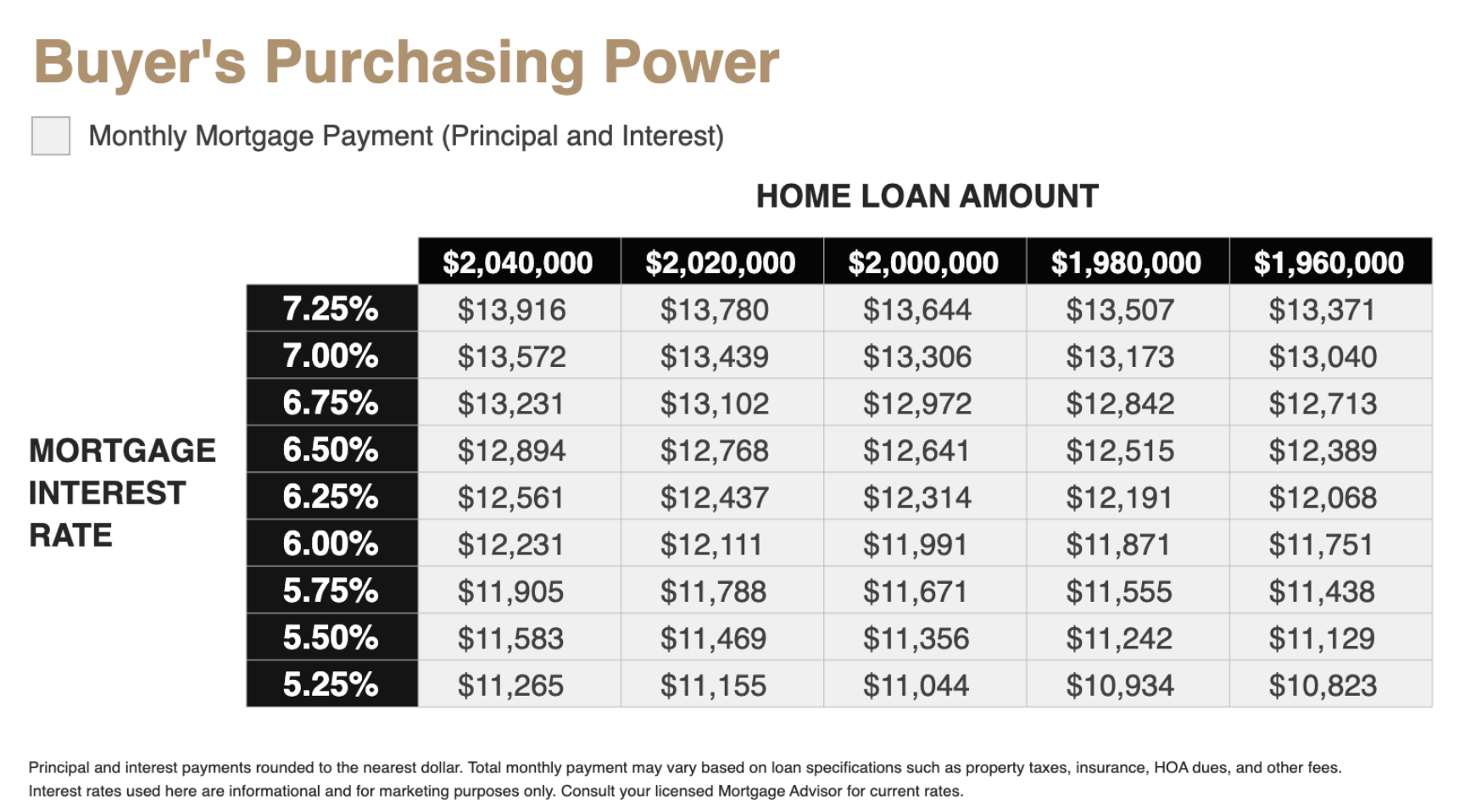

A small rate decline can make a significant difference in your monthly mortgage payment because interest is a key factor in the total cost of borrowing. For example, if mortgage rates drop from 7.25% to the low 6% range, this reduction can lead to considerable savings over the life of your loan.

- Lower Monthly Payments: A decrease in the interest rate reduces the amount of interest you’ll pay each month. Even a small reduction can lead to savings of hundreds of dollars per month, depending on the loan size. This means more of your payment goes toward the loan principal, helping you build equity faster.

- Affordability of Larger Loans: With a lower interest rate, you may qualify for a larger loan while keeping your monthly payment within a similar range as you would at a higher rate. This opens up opportunities for purchasing a higher-value home without drastically increasing your monthly financial commitment.

- Long-Term Savings: For a 30-year mortgage, the cumulative effect of a lower interest rate could result in tens of thousands of dollars in savings. For instance, on a $2,000,000 loan, even a 1% drop in interest could save over $60,000 in interest payments over the life of the loan.

- Improved Financial Flexibility: A lower monthly mortgage payment means you have more financial breathing room for other expenses, savings, or investments. This can be especially valuable if you plan to make improvements to your new home, start a family, or save for retirement.

In short, even a small drop in rates, like moving from 7.25% to the low 6% range, has a ripple effect, increasing your purchasing power, reducing your monthly burden, and saving you significant money over time.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link